9494274019 How to Invest in Emerging Markets for Maximum Growth

Investing in emerging markets offers significant growth opportunities but demands a strategic, well-informed approach. Success hinges on understanding local political and economic conditions, diversifying investments across sectors, and managing currency risks effectively. While these markets promise high returns, they also pose unique challenges that require careful navigation. Identifying the right entry points and risk mitigation strategies is crucial for sustained growth. Exploring these key considerations can determine whether such investments truly maximize potential.

Key Factors to Consider Before Investing

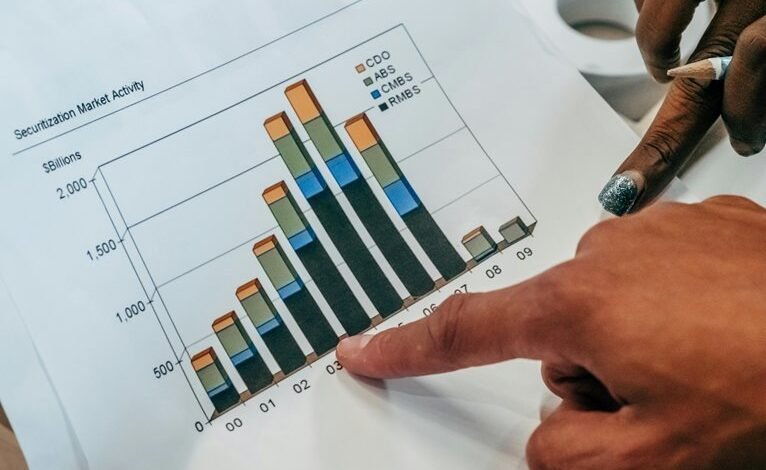

Before committing capital to emerging markets, investors must carefully evaluate critical factors such as market volatility and political stability.

High volatility can erode gains, while political instability increases risks and unpredictability.

Understanding these elements is essential for those seeking financial freedom, as they directly impact potential returns and the sustainability of investments in these dynamic environments.

Strategies for Effective Market Entry

What are the most effective approaches for entering emerging markets successfully? Prioritizing cultural adaptation ensures resonance with local consumers, fostering trust and loyalty. Establishing strategic local partnerships accelerates market penetration, providing invaluable insights and resources.

These strategies empower investors seeking freedom through informed, adaptable entry methods that build sustainable growth while respecting local nuances.

Managing Risks and Maximizing Returns

Effective market entry strategies lay the groundwork for sustainable growth, but managing risks and maximizing returns determine long-term success in emerging markets.

Addressing currency risks and political stability is crucial; prudent investors diversify holdings and monitor geopolitical developments.

These strategies empower investors to harness growth opportunities while safeguarding their freedom to adapt and thrive amid market volatility.

Conclusion

In conclusion, successful investment in emerging markets hinges on thorough understanding and strategic adaptation. By diversifying holdings, fostering local partnerships, and remaining vigilant to geopolitical and currency risks, investors can capitalize on growth opportunities. As the adage goes, “Don’t put all your eggs in one basket,” emphasizing the importance of risk mitigation. A disciplined, well-informed approach maximizes potential returns while safeguarding against volatility, paving the way for sustainable long-term success in these dynamic economies.